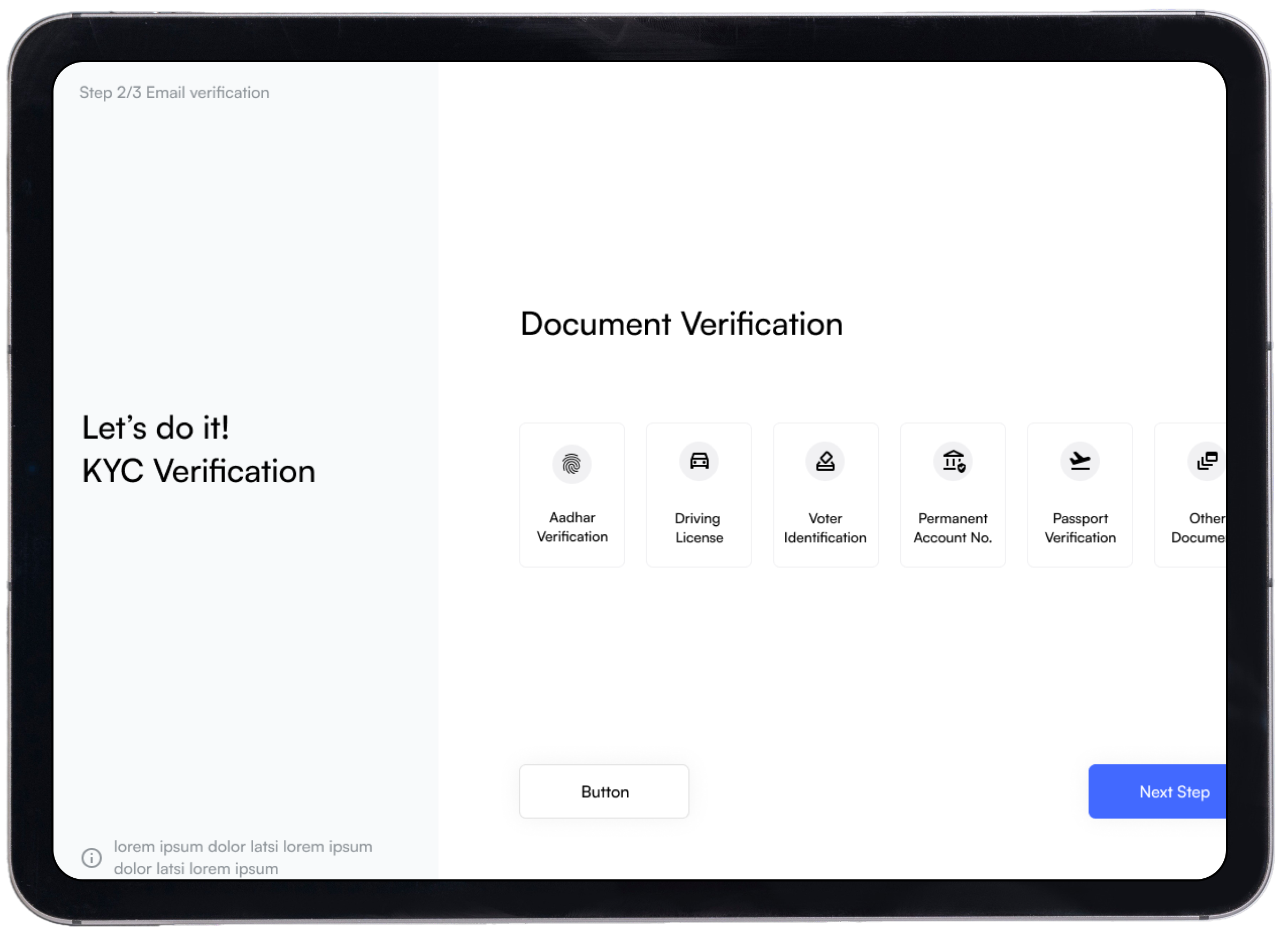

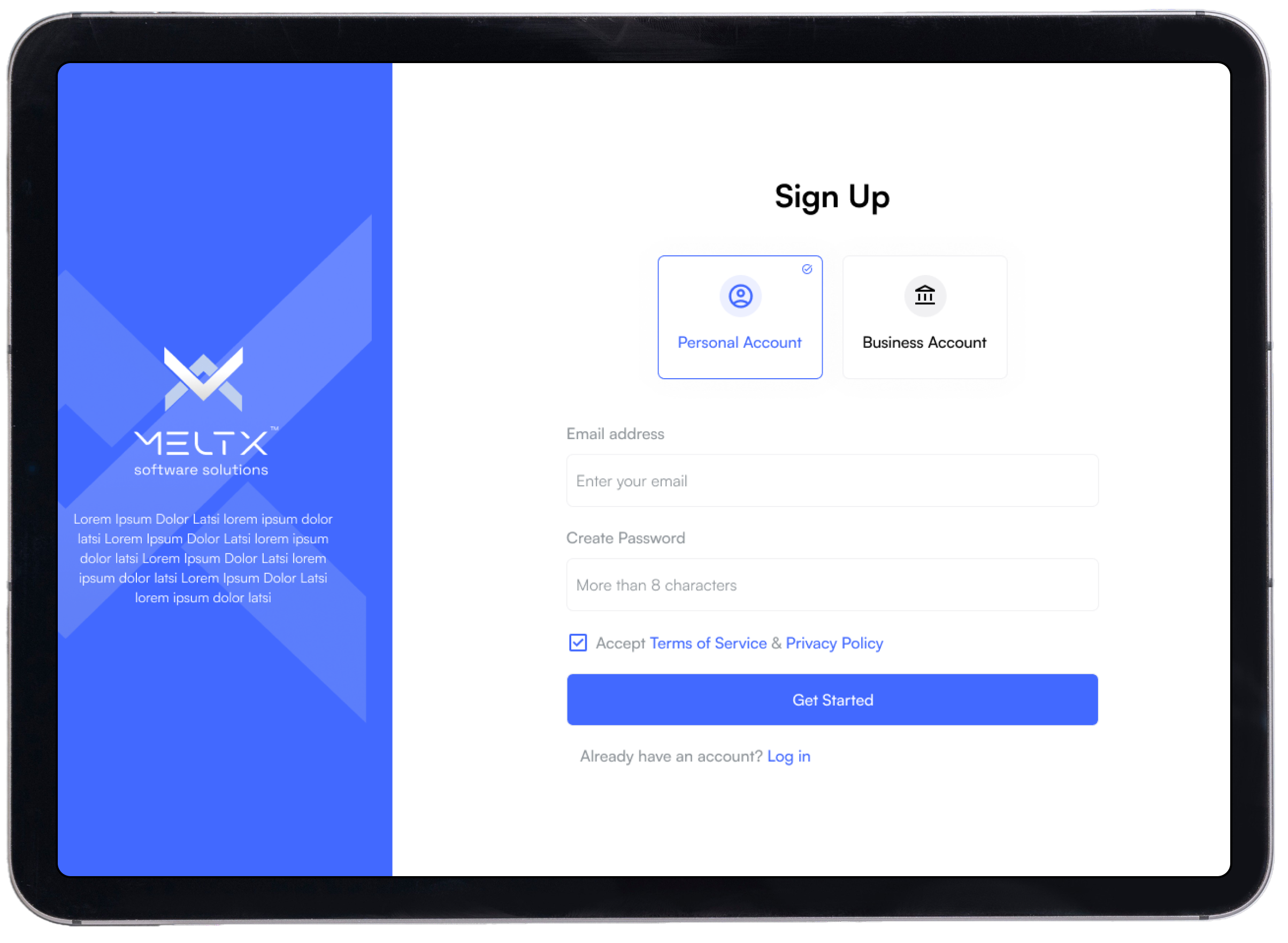

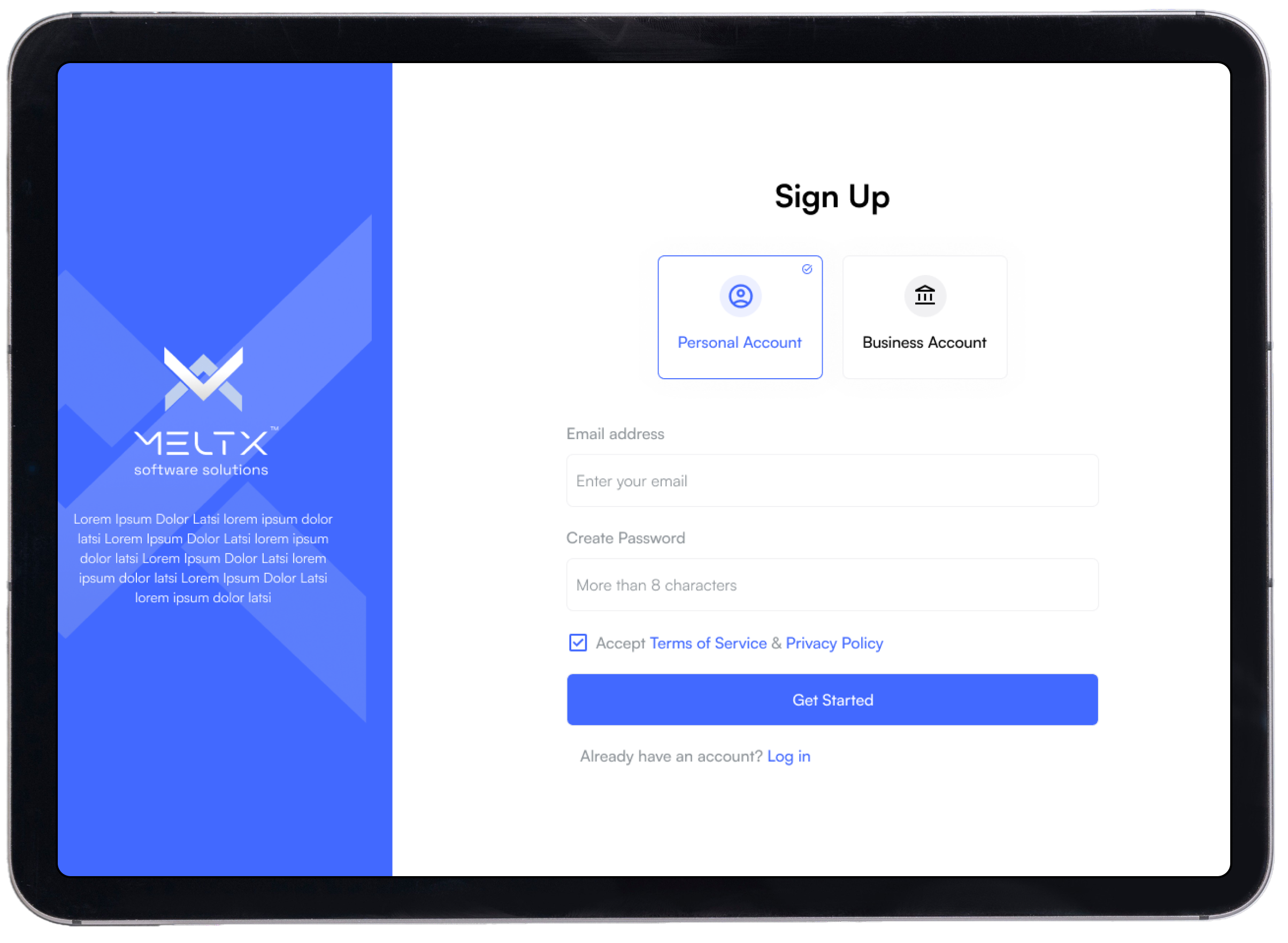

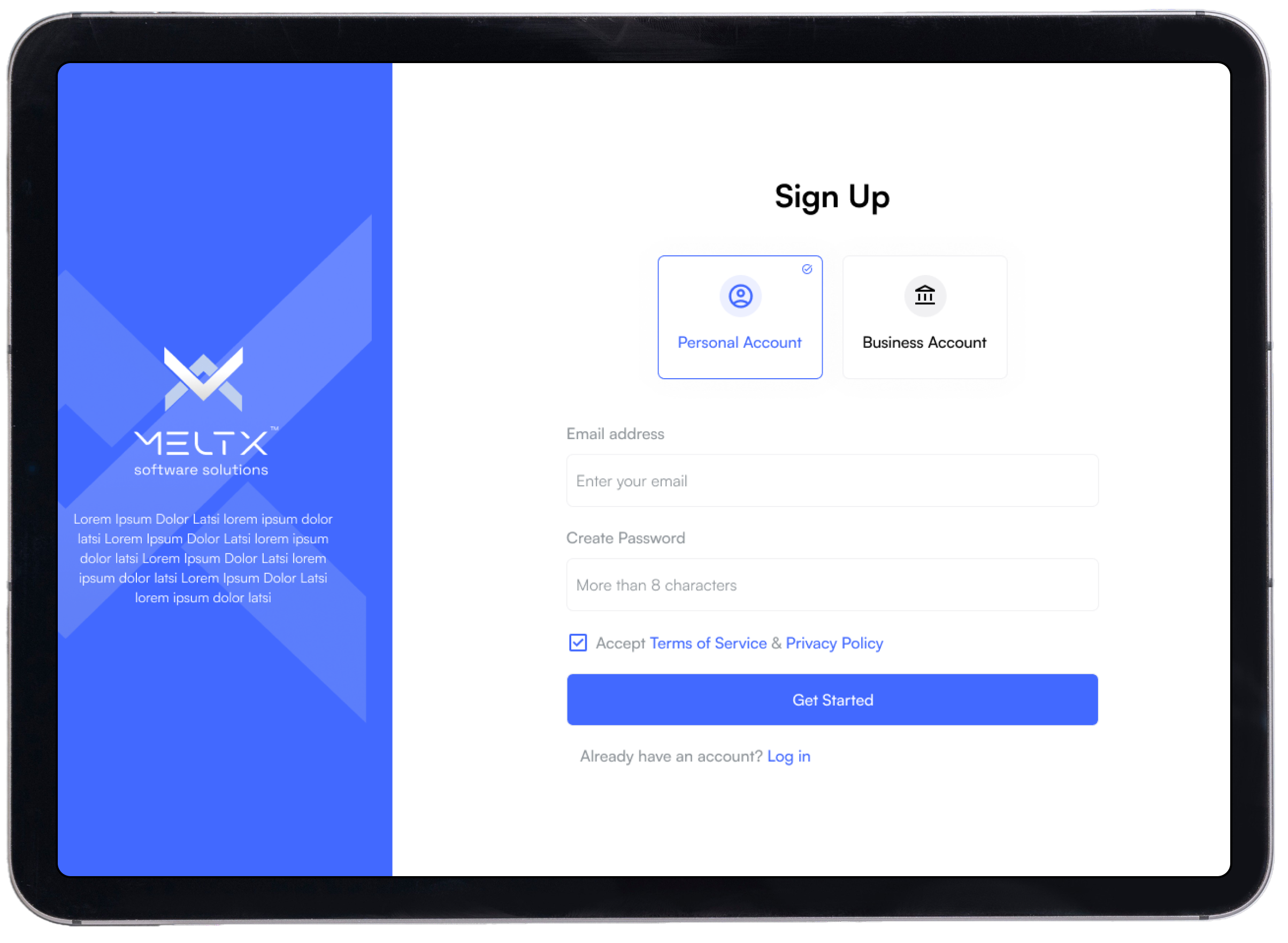

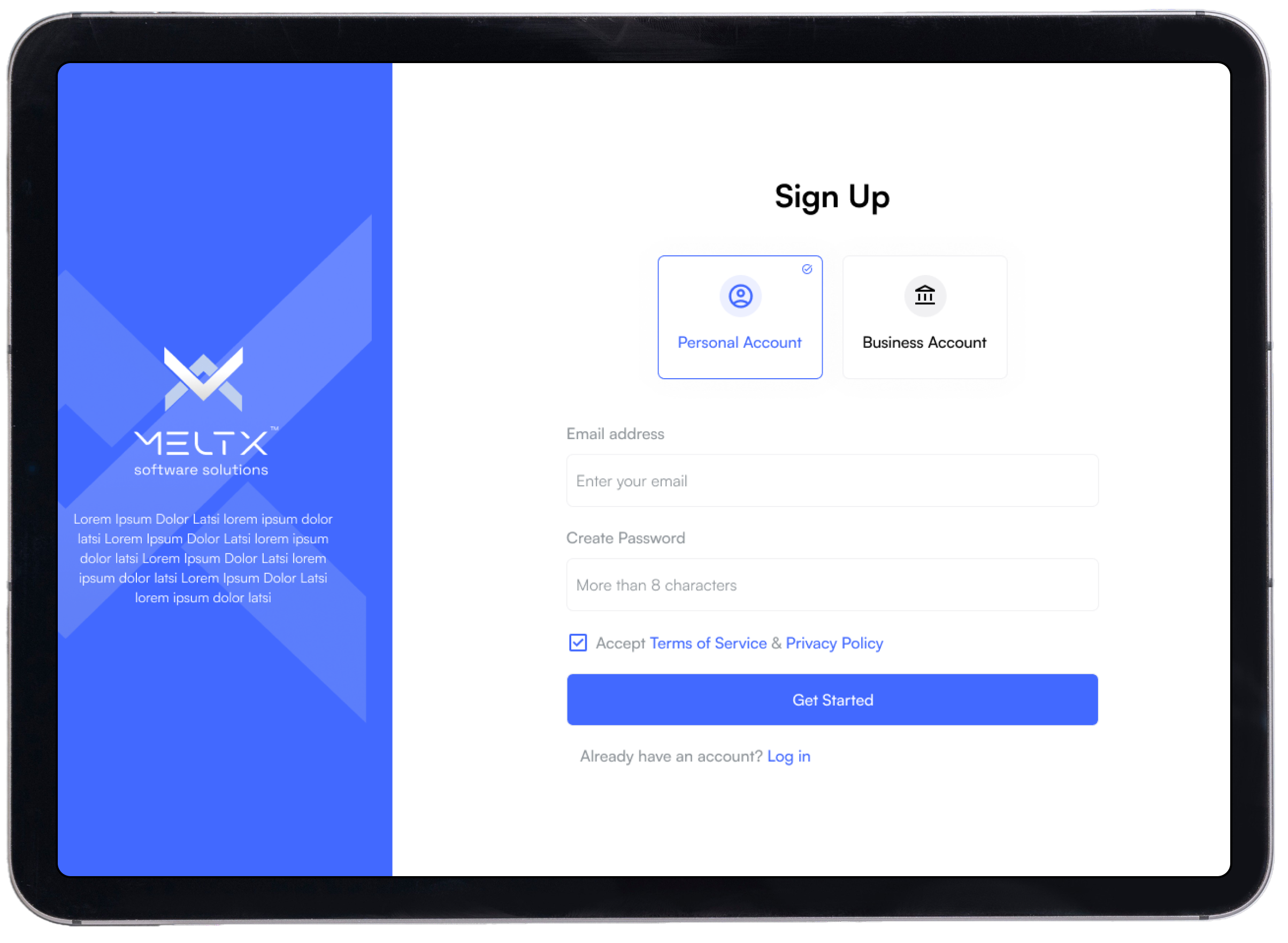

KYC Verification & Validation System for Digital Onboarding

MeltX KYC Verification System enables organizations to verify identities securely while meeting regulatory and compliance requirements.

Challenges in KYC & Identity Verification

Organizations face delays in onboarding due to manual verification, document mismatches, and evolving regulatory requirements. Lack of centralized records increases audit risks, while poor verification mechanisms expose institutions to fraud and non-compliance penalties.

Slow and manual KYC processes

High risk of errors and fraud

Difficulty meeting regulatory requirements

Poor audit readiness

Core Capabilities of MeltX KYC Verification System

MeltX enables secure, fast, and compliant identity verification.

Real-Time Identity Verification

Perform instant identity verification using secure API integrations.

Multi-Document Validation

Support verification of Aadhaar, PAN, Driving License, Passport, and more.

DigiLocker-Based Validation

Validate documents directly from trusted DigiLocker sources.

Audit Logs & Traceability

Maintain detailed verification logs for every transaction.

Configurable Compliance Rules

Adapt verification workflows based on regulatory or organizational requirements.

Benefits of MeltX KYC Verification System

Accelerate onboarding while maintaining trust and compliance.

Reduced Operational Cost

Automate manual verification tasks to save resources and improve internal efficiency.

Enhanced Security Posture

Proactively block fraudulent activity and strengthen overall digital security protocols.

Scalable Verification

Easily onboard multiple users daily without sacrificing verification quality or speed.

Simplified Auditing

All transaction data is automatically logged, making regulatory audits instantaneous and easy.

Ready to See MeltX in Action?

Schedule a personalized demo with our team and explore how

MeltX fits your organization.